Note: If you think you are a victim of a scam targeting Navy Federal Credit Union customers, Attorney Gary Byler is representing victims for free. His contact information is at the end of this article.

NORFOLK, Va. – Local attorney Gary Byler says he's taken complaints from more than 30 people who say they were targeted in a widespread scam, leaving them responsible for thousands of dollars. This comes after a WTKR News 3 investigation into what federal prosecutors call the "parking lot scam" targeting Navy Federal customers.

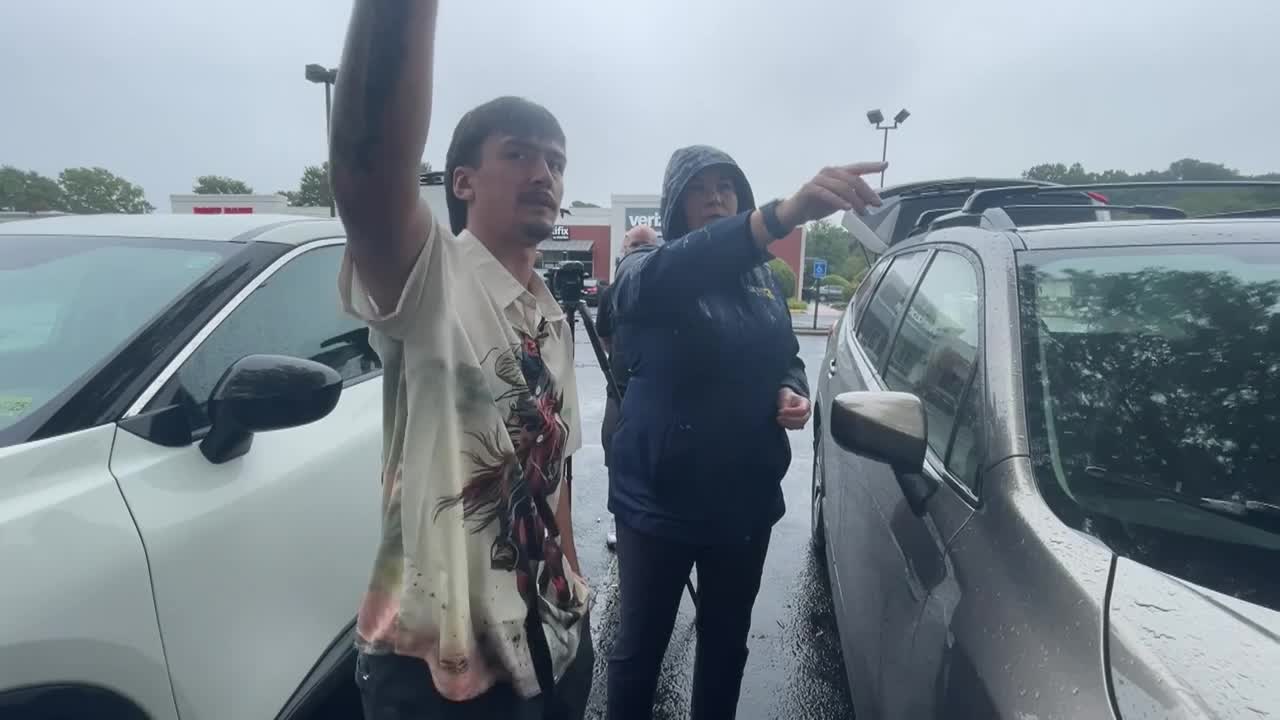

In the scheme, suspects approach a person, ask to use their phone, then secretly use the owner's mobile banking app to apply for and transfer money from a personal loan.

Authorities say there are several different kinds of ways the money is leaving the accounts.

Previous coverage: Attorney fights Navy Federal over personal loans customers say were unauthorized

Over the past year, the WTKR News 3 Investigative Team has spoken with multiple people who say they've fallen victim to the scam. After seeing one of our recent investigations, Byler said he was "flabbergasted" to learn about victims being required to pay back personal loans that suspects took out. He's now representing impacted Navy Federal customers for free.

Byler said complaints starting pouring in after our report with him aired last week. Our story included Byler's contact information, which he provided so potential victims could reach out to his office.

"We have been flooded with calls, mostly from coastal Virginia, but several from Florida, Kentucky, Northern Virginia, California, and the pattern is always the same," Byler said. "It's an obvious fraud."

Previous coverage: Feds arrest 10 suspects in massive scheme targeting Navy Federal customers

One of the first victims to speak out to WTKR was Travis Minson, who said the incident happened over a year ago when a stranger asked to use his phone in a parking lot near the Lynnhaven Mall in Virginia Beach.

"That day I was in a good mood and I just felt like being a helpful person," Minson said.

Watch: Scam targeting Navy Federal customers costing victims thousands in Hampton Roads

Within minutes, he said, the suspects had applied for a $7,000 personal loan through his Navy Federal app. With interest, he said he was told he owed the credit union $10,000. Minson said he reported the fraud almost immediately, adding that the information on the loan application — including his job title and how long he had worked there — was wrong.

"I got the police report. I went to the police, [and] police said that they’re aware of what’s going on," Minson said. "They told me that Navy Federal was also aware of what’s going on, so I didn’t understand why Navy Federal is not trying to help in the situation."

"There was no verification of employment, no phone call to verify any authentication to the application. It was all fraudulent from the get go," said Minson's father. "He made a mistake. I don’t think it’s a $7,000 mistake that should be paid back to [a] bank that knows it's fraud."

Previous coverage: Victims warn community after losing thousands in seconds

Byler called the stories he has heard from victims "heart-wrenching, particularly the disabled veteran who was sobbing. It's just absolutely outrageous."

He said he got another call from a widow who said someone accessed her husband's cell phone while he was dead and took their money.

The latest Navy Federal Credit Union statement issued to WTKR is as follows:

Navy Federal Credit Union is deeply concerned about these schemes and is actively cooperating with law enforcement in investigations. These cases illustrate how important it is to treat an authenticated banking app with the same level of caution as a wallet.

We have also taken several steps to protect our members from this type of fraud, including member education campaigns focused on mobile device safety and scam awareness.

We also encourage members to enable additional security features within payment apps—such as Face ID or biometric authentication—on platforms like Venmo, Cash App, and Zelle to help prevent unauthorized access.

These types of scams can happen anywhere, not just in Virginia. We encourage all members—regardless of location—to remain vigilant and cautious about letting others use their phones, especially in unfamiliar or high-traffic public areas.

If you believe you’ve been targeted or affected by this type of scam, please contact your local police department immediately. Navy Federal is committed to supporting our members and encourages anyone impacted to also reach out to us directly.

WTKR asked Navy Federal why people were being forced to pay back loans they say they didn't authorize. In a previous statement, the credit union said: "Navy Federal only holds members financially responsible for transactions where there is evidence they authorized the transfer or loan. Each case is reviewed individually, and outcomes may vary based on available evidence and legal proceedings."

Previous coverage: Navy Federal customer forced to pay back loan she didn't take out after scam

Byler has contacted Navy Federal on behalf of his clients and is working to get the loans forgiven.

"It's an ongoing process. We're gonna know more by the end of the week and it will probably be months and months to get a proper resolution," Byler said. "But I can assure you, our office will not walk away from this just because it's difficult."

Byler said he's representing these victims free of charge and encourages anyone who thinks they've been affected by this scam to contact him:

- Gary Byler's cell: 757-619-4345

- Gary Byler's email: gary@garybyler.com