A Hampton Roads attorney has secured the first settlement in what federal prosecutors call "the parking lot scam," providing hope for dozens of victims who were targeted by strangers claiming emergencies.

Attorney Gary Byler took action after seeing a News 3 investigation in September, representing victims like Matt Tignor who was approached by strangers in a parking lot asking to use his phone.

The scammers took out a personal loan in Tignor's name while using his mobile app, leaving him responsible for repaying it with 18% interest.

"He listened to us, and he's doing everything, because I looked into an attorney myself and I know I couldn't really afford one," Tignor said.

Watch related: True Crime 757 takes on the case of the parking lot scam

Victims are typically approached by strangers claiming to have emergencies who ask to use their phones, then use the victims' personal information to fraudulently obtain loans, steal money out of their accounts or transfer money to the suspects own personal accounts.

Prosecutors outline in the indictment there are several different kinds of ways the money is being stolen.

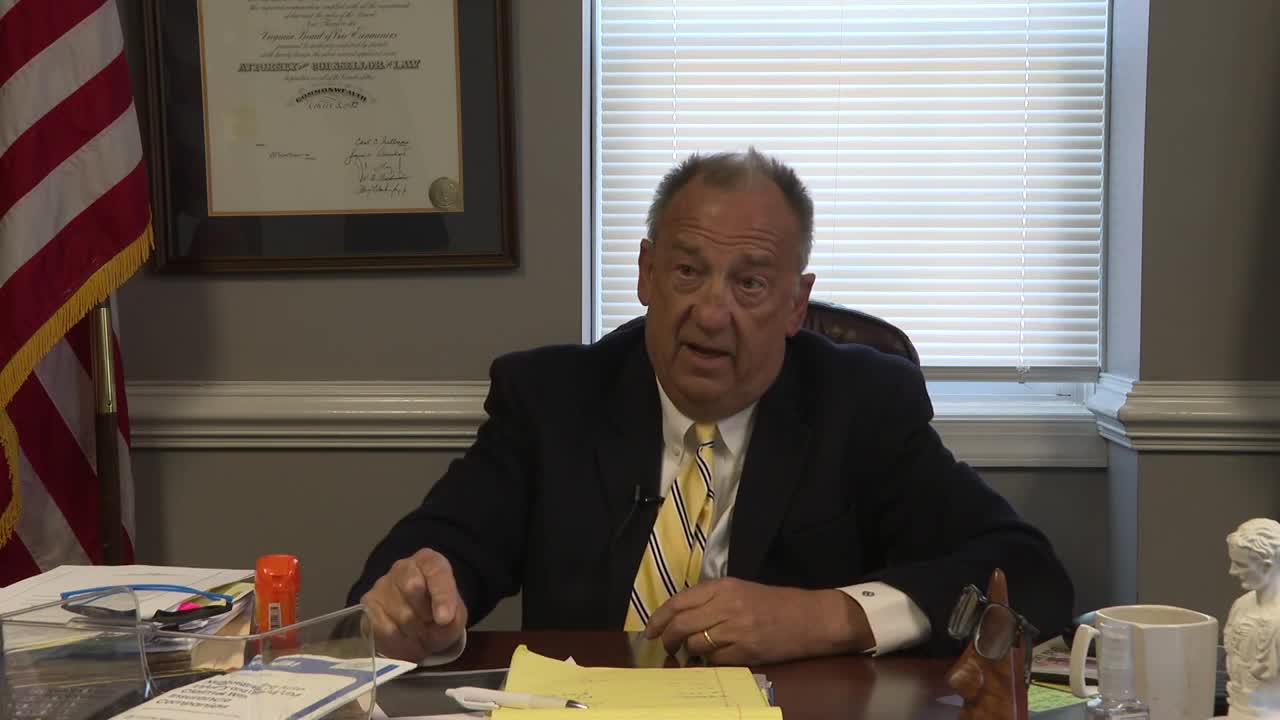

"As soon as I saw your story, I'm like this is not right we need to do something about it," Byler said.

After News 3 broadcasted Byler's offer to help victims, he said he received dozens of calls from people in similar situations.

Watch related: New legislation introduced following WTKR investigation of parking lot scam

He filed two individual lawsuits and has now finalized the first settlement.

He said he has filed at least 12 demand letters for other victims.

"We finalized in print with the court the settlement on the first of the Navy Federal fraud cases," Byler said. "A very satisfying day in court. Sometimes the legal process can be drawn out and unsatisfying, but today's one of those days that makes me happy to be a lawyer."

Byler argued that victims shouldn't be held responsible for loans they never applied for or received money from.

"If you didn't apply for the loan. If you didn't get the money and you promptly report it, but of course the debt can't be on you to say otherwise the entire banking system would collapse," Byler said.

The attorney representing Navy Federal declined to comment on pending litigation, citing company policy when WTKR approached him in the courthouse.

Watch related: Navy Federal hires local attorneys as parking lot scam lawsuits move forward

Byler said he hopes to settle all of the cases without filing individual lawsuits for each victim. He said the issue extends beyond Navy Federal to other banking institutions.

For Byler, getting involved was a moral imperative after seeing the WTKR investigation.

"You see a bully picking on somebody who is smaller and you have the ability to do something about it. 100 times out of 100 you stop at that playground. Never do you walk by," Byler said.

Tignor said the fraudulent loan devastated him financially, bringing him to a breaking point before Byler stepped in to help.

The parking lot scam continues to be investigated by federal prosecutors as victims across the region seek justice and financial relief.

Previously, Navy Federal issued statements saying they're deeply concerned about these schemes and actively cooperating with law enforcement. They said these cases illustrate how important it is to treat an authenticated banking app with the same level of caution as a wallet. The credit union also said they've taken several steps to protect their members from fraud.